Your money is personal, so merging your financial life with a partner is a big deal. It requires trust, a shared vision of your future, and of course, some logistics. When it comes to your household finances, both partners need visibility, control, and access—and sometimes, to keep certain accounts separate. But many financial institutions don’t make that easy, and what should feel like a major relationship milestone ends up feeling like a problem to be solved.

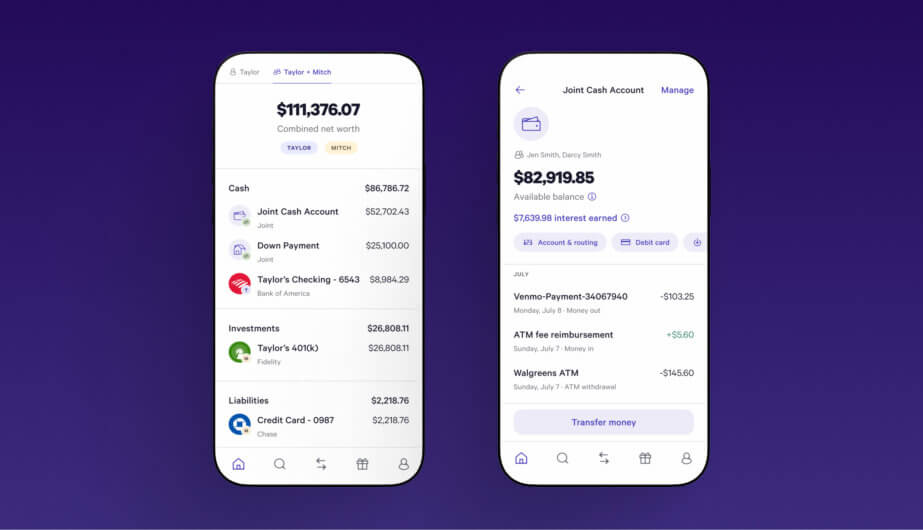

We’ve talked with many of our clients to understand this challenge, and we set out to solve it. As a result, we believe we’ve built the best joint experience on the market for your shared savings and wealth-building. We’re excited to announce that starting today, joint Cash Accounts now have checking features, enabled by shared account & routing numbers, so you and your co-owner can both benefit from direct deposit, debit cards, and the ability to pay shared bills directly from the account. A joint Cash Account also offers:

- An industry-leading Annual Percentage Yield (APY) of 3.25% from our program banks

- A shared view of your finances right in the Wealthfront app when you link your external accounts

- Easy transfers between your individual and joint Cash Accounts

- The ability to see which account co-owner handled each Cash Account transaction

- Free 24/7 instant withdrawals

- Access to 19,000 free ATMs, and two ATM fee reimbursements per month (up to $7.50 each)

- Free wires

- Up to $16 million in FDIC insurance through our program banks ($8 million for individual accounts)

- And as always, no account fees

The Wealthfront Cash Account can be a powerful tool for building shared wealth with a partner until you’re ready to invest, and many couples are already using it to reach their goals: The average joint Cash Account balance is an impressive $80,000.

Want to level up your joint financial plan? In this post, we’ll explain how you and your partner can get the most out of your joint Cash Account.

Set up shared views for a clear picture of your joint finances

Couples are faced with several choices when they combine finances: share everything, share nothing, or share some things. There isn’t necessarily one right answer—only what works best for your particular situation. Most financial institutions don’t make navigating this decision easy, but Wealthfront supports all three options.

Using the Wealthfront app, you can see your combined net worth at a glance (accounting for linked external accounts in addition to your Wealthfront accounts) and get a clear picture of where you stand today. Individual accounts that you don’t want to include in this view stay private—that’s totally up to you. Whatever you decide, getting a clear view of your joint finances can help you and your partner make more informed decisions together.

Direct deposit your paychecks to earn a high APY on every shared dollar

Earning an industry-leading APY on your shared cash can have a big impact on your joint savings over time. But manually transferring both of your paychecks into your Cash Account every pay cycle can be tiresome. Using direct deposit can save you some work, and both you and your co-owner can now easily set up direct deposit in the Wealthfront app.

Just use your joint account and routing numbers and follow the instructions from your payroll provider. When you direct deposit your paychecks to your Cash Account, every dollar starts working harder than it would in a traditional, low-interest savings account from the moment it arrives. And with free instant withdrawals available around the clock, every day of the year, you don’t have to worry about your funds being readily accessible in a pinch.

Get two debit cards so you can both access cash when you need it

Whether you’re at the farmers market, a yard sale, or a neighborhood lemonade stand, sometimes you just need cash. It’s important to make sure both you and your partner can get what you need quickly and without paying exorbitant ATM fees while you’re at it.

The Wealthfront Cash Account comes with debit cards for both account holders and access to up to more than 19,000 free ATMs nationwide. But what if you or your partner can’t make it to one of those ATMs? We’ll also reimburse two out-of-network ATM fees per month, up to $7.50 each.

Set up recurring deposits for saving and investing

It’s easier to make good financial decisions together when you automate them. That includes setting up automatic transfers from external accounts to your Cash Account (where it can work harder for you by earning an industry-leading APY through our program banks) and using automatic transfers from your Cash Account to your investing account.

Automated deposits to your joint investing account aren’t just convenient—they can help you build long-term wealth together and work towards larger financial goals like retirement or sending a child to college. Some investors struggle to pick the “right” days to invest, and end up sitting on the sidelines as a result. But removing this friction so you can add to your investments consistently over time can be very powerful. By getting into the market, you and your partner can give your savings an opportunity to grow and compound even more over the long term than they would in a Cash Account.

Getting started will require some conversations with your partner: You should talk about your time horizon, your risk tolerance, and the account type that’s best suited to your goals. For a deeper dive on the tradeoffs of various Wealthfront investing accounts, you can check out this blog post on the subject. Whatever you choose, know that the Cash Account is designed to be an ideal place to keep your money until you’re ready to invest.

Build long-term wealth, together

We’re delighted to offer what we consider to be a best-in-class joint account experience to Wealthfront clients. Our joint Cash Account isn’t just a great place to earn interest and access your money instantly, 24/7 (although it is very good for those things)—together with the Wealthfront app, it’s a true hub for you to manage the full range of financial decisions you’ll make with a partner.

Disclosure

The Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), Member of FINRA/SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and the Cash Account itself is not a deposit account. The Annual Percentage Yield (“APY”) on cash deposits as of June 30, 2025, is representative, requires no minimums, and may change at any time. The APY for the Wealthfront Cash Account represents the weighted average of the APY on the aggregate deposit balances of all clients at insured depository institutions that participate in our cash sweep program (the “Program Banks”). Wealthfront sweeps available cash balances to Program Banks where they earn a variable rate of interest and, subject to the satisfaction of certain conditions, are eligible for FDIC insurance. A list of current Program Banks can be found here: [https://www.wealthfront.com/programbanks]. Deposit balances are not allocated equally among the participating program banks. FDIC pass-through insurance is not provided until the funds arrive at the Program Banks, and protects against the failure of Program Banks, not Wealthfront. While cash balances are at Wealthfront Brokerage, and while they are transitioning to and/or from Wealthfront Brokerage to the Program Banks, they are not eligible for FDIC pass-through insurance, but are eligible for SIPC protection, subject to the limit of $250,000 for cash. FDIC insurance coverage is limited to $250,000 for the total amount of all deposits a customer holds in the same ownership capacity per banking institution, regardless of whether those deposits are placed through Wealthfront Brokerage, so you are responsible for monitoring your total deposits at each Program Bank to avoid exceeding FDIC limits. Wealthfront Brokerage partners with more than one Program Bank to make available up to $8 million of FDIC pass-through coverage for your cash deposits. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the Program Banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The deposits at Program Banks are not covered by SIPC.

Instant and same day withdrawals may be processed through the Real-Time Payments (RTP) network or the FedNow service, enabling same day withdrawals. Real-Time Payments (RTP) transfers and FedNow instant payment transfers may be limited by destination institutions, daily transaction caps, and by participating entities such as Wells Fargo, the RTP® Network, and FedNow® Service. New Cash Account deposits are subject to a 2-4 day holding period before becoming available for transfer. Wealthfront doesn’t charge for transfers, but some receiving institutions may impose an RTP or FedNow fee. Processing times may vary.

Wealthfront Brokerage has partnered with Green Dot Bank to offer certain checking features including The Wealthfront Visa® Debit Card, send a check, and mobile check deposits to Wealthfront Cash Accounts. The Wealthfront Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. The checking features provided by Green Dot Bank for Wealthfront Cash Accounts are subject to identity verification by Green Dot Bank and the Wealthfront Visa® Debit Card is optional and must be requested. Green Dot Bank operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Wealthfront brokerage and advisory services are not affiliated with Green Dot Bank.

Fee-free ATM access applies to in-network ATMs only. For out-of-network ATMs and bank tellers a $2.50 fee will apply, plus any additional fee that the owner or bank may charge. Fees and Eligibility requirements may apply to certain checking features, please see the Deposit Account Agreement for details. Copyright 2025 Green Dot Corporation. All rights reserved.

The domestic out-of-network ATM fee reimbursement program (the “Program”) allows Wealthfront Brokerage clients with open and funded Individual and Joint Wealthfront Brokerage Cash Accounts (“Cash Account”) who have requested and received an accompanying debit card(s) (“Debit Card”) issued by Green Dot Bank (“Green Dot”) to be eligible for certain account benefits when using their Debit Card for a domestic out-of-network ATM cash withdrawal of U.S. dollars (“ATM Transactions”) when their Wealthfront accounts, Green Dot accounts (collectively, “Accounts”), and Debit Card remain open, active, and in good standing.

Each calendar month, current eligible clients with ATM Transactions will receive a reimbursement of certain fees associated with their first two ATM Transactions on a per-card, per account basis. Please note, replacement debit cards aren’t eligible for additional reimbursements above that limit. Wealthfront Brokerage will utilize its best efforts to reimburse Green Dot’s $2.50 “out-of-network fee” and up to $5.00 of any operator or owner’s fee for your ATM Transactions, up to a maximum reimbursement of $7.50 per ATM Transaction (the “Reimbursement”). Your maximum total monthly Reimbursement shall be $15.00 ($7.50 + $7.50) per card, per account. If an ATM operator charges fees other than out-of-network fees and/or owner’s fees, Wealthfront Brokerage will not reimburse any portion of those fees. Once the maximum total monthly Reimbursement has been reached, no subsequent out-of-network ATM fees or charges that occur that calendar month will be reimbursed. ATM Transactions completed before September 16, 2024 shall not be eligible for Reimbursement in connection with this Program. Wealthfront Brokerage reserves the right to modify or terminate the Program at any time without notice. For full details please review the Out-of-Network ATM Fee Reimbursement Terms and Conditions.

Wealthfront does not charge for wire fees to title and escrow companies and accounts you own at other institutions, but the receiving entity or institution may charge a fee. For more information about wires, visit

www.wealthfront.com/legal/online-transfer-agreement.

Fees and Eligibility requirements may apply to certain checking features, please see the Deposit Account Agreement for details.

Wealthfront Brokerage has established a relationship with UMB Bank, National Association (“UMB Bank”), Member FDIC, which may allow Wealthfront Joint Cash Accounts to opt-in to a limited-purpose account number and UMB Bank routing and transit number which will enable certain withdrawals and deposits into Wealthfront Cash Accounts including bill pay, direct deposits, and payments through third-party sites through the Automated Clearing House network. Wealthfront brokerage and advisory services are not affiliated with UMB Bank.

Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC-registered investment adviser, and brokerage related products, including the Cash Account, are provided by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a Member of FINRA/SIPC. Financial planning tools are provided by Wealthfront Software LLC (“Wealthfront Software”).

Wealthfront Advisers, Wealthfront Brokerage, and Wealthfront Software are wholly-owned subsidiaries of Wealthfront Corporation.

Copyright 2025 Wealthfront Corporation. All rights reserved.

About the author(s)

Dave Myszewski is the Vice President of Product at Wealthfront where he oversees product development, consumer research, and client support. Prior to Wealthfront, Dave worked at Apple for 12 years including an engineering role on the first iPhone. Dave holds an MS and BS in Computer Science from Stanford University. View all posts by Dave Myszewski